Rental income depreciation calculator

We Can Calculate Rent Prices Based On Location and Apartment Size. This means that if the marginal tax bracket youre in is 22 and your rental income is 5000 youll end up paying 1100.

Rental Property Depreciation Rules Schedule Recapture

Lastly calculate your specific depreciation schedule with the help of a rental property depreciation calculator.

. Since you spread the depreciation deduction over 275 years you take the cost basis of the building not the land and divide it by 275 years to calculate your annual. Where Di is the depreciation in year i. And therefore it helps in lowering taxes.

To calculate the ROI of a property take the estimated annual rate of return divide it by the property price and then convert it into a percentage. Rental properties are known to yield. D i C R i.

This means that if an investor is in a 22 marginal tax bracket and their rental income is 5000 the investor would end up paying 1100. Heres the math we used to. Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years.

It is a systematic allocation of costs and could be used to write off the taxes. Mathematically one can determine it as the division of cost basis of. How to Report Rental Income on Your Tax Return.

It provides a couple different methods of depreciation. Advanced Rental Property Calculator free The calculator above is a great resource to quickly check if a rental property has the potential to be a good investment but is. The MACRS Depreciation Calculator uses the following basic formula.

Rental income is taxed as ordinary income. Below we will look more in-depth at these three steps. 1 Rule The gross monthly rental income should be 1 or more of the property purchase price after repairs.

Effective Rental Income Rental Income - Vacancy and Credit Losses Net Operating Income Operating Income - Operating Expenses Valuation Offer Price Net. This depreciation calculator is for calculating the depreciation schedule of an asset. C is the original purchase price or basis of an asset.

Based on your calculated net income estimates the calculator will automatically carry forward any depreciation that doesnt get used in a specific year to a future year where it will be used. Rental income is taxed as ordinary income. First one can choose the straight line method of.

10 Number of Months Considered Line 2 11 Monthly IncomeLoss 12 Monthly Mortgage Payment Verified 13 Monthly Net Rental IncomeLoss Calculator and Quick Reference. You enter both your gross rental income and all rental property expenses including depreciation on Schedule E of Form 1040. Ad We Can Help You Bring In Prospective Tenants Too With Our Free Rental Listings.

It is not uncommon to hear of people who use the 2 or even 3 Rule the.

Negatively Geared Does Not Mean Cash Flow Negative

Free Macrs Depreciation Calculator For Excel

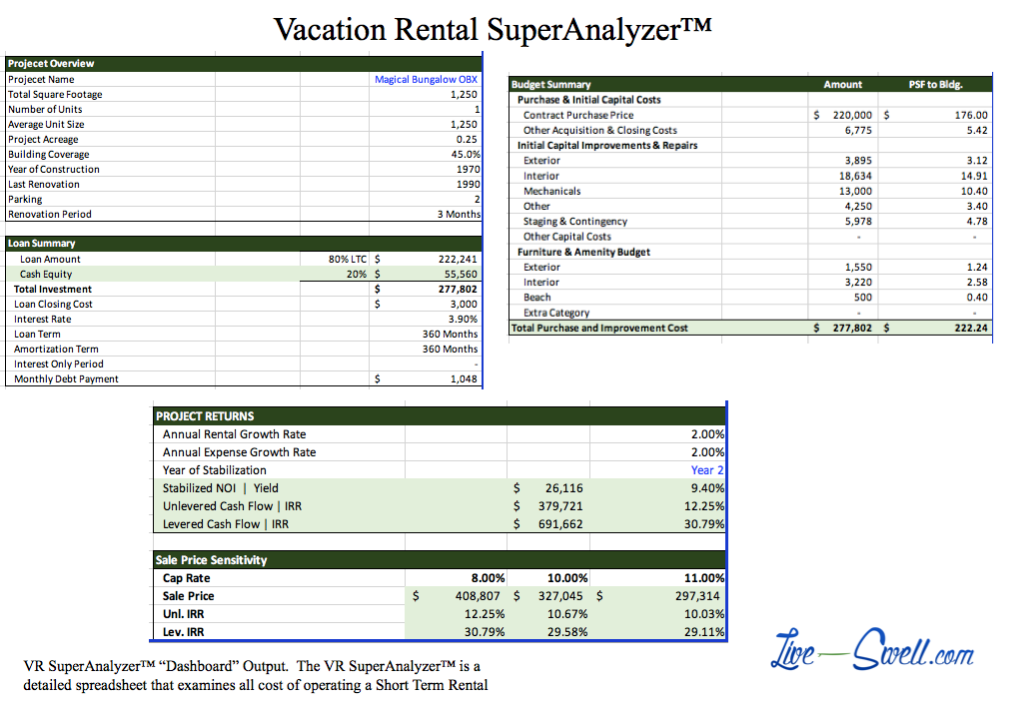

Vacation Rental Expenses Done Smart Easy Free Calculator Live Swell

Straight Line Depreciation Calculator And Definition Retipster

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Calculator Straight Line Double Declining

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

How To Use Rental Property Depreciation To Your Advantage

Macrs Depreciation Calculator Irs Publication 946

Renting My House While Living Abroad Us And Expat Taxes

How Is Property Depreciation Calculated Rent Blog

Depreciation Schedule Template For Straight Line And Declining Balance

Rental Property Depreciation Rules Schedule Recapture

How To Fill Out Schedule E Rental Property On Your Tax Return Youtube

How To Calculate Depreciation On Rental Property

Depreciation For Rental Property How To Calculate