Discounted present value

What is Net Present Value NPV. Particularly for loans mortgages bonds perpetuity etc.

What Is Net Present Value Business Valuation Time Value Of Money Personalized Learning

Go for an automatic tool to calculate PV of cash flows if you want to be sure that your calculations are quick and precise.

. Their returns are reflected in a residual value that equals the present value of the perpetuity discounted to the last year of the forecasts time horizon. The moneys discounted present value should you decide not to use this money now to purchase goods and services for certain number of years taking into the account the moneys annual inflation or discount rateYou can also use this present value calculator to ascertain whether it makes sense for you to lend your. Screenshot of CFIs Corporate Finance 101 Course.

Is the current value of a future sum of money discounted by a specified rate of return. Hence he can opt to withdraw from the FD fund as it maxes the present value amount in hand. The formula for the discounted sum of all cash flows can be rewritten as.

NPV analysis is a form of intrinsic valuation and is used extensively across finance and accounting for determining the value of a business investment security capital project new. Using the Online Calculator to Calculate Present Value of Cash Flows. What is the present value of 84253 to be received or paid in 5 years discounted at 11 by table and factor formula.

NPV for a Series of Cash Flows. Calculate how much is your money worth in todays prices ie. Present Value - PV.

Residual Value Net Present Value perpetuity interest rate. Present Value Net Present Value. Under this method the expected future cash flows are projected up to the companys life or asset and a discount rate discounts the said cash flows to arrive at the present value.

Then all are summed such that NPV is the sum of all terms. The calculation of this value requires 2 assumptions. 84253 PVIF 11 5 Download Present Value Tables.

Net present value method also known as discounted cash flow method is a popular capital budgeting technique that takes into account the time value of moneyIt uses net present value of the investment project as the base to accept or reject a proposed investment in projects like purchase of new equipment purchase of inventory expansion or addition of. In most cases a financial analyst needs to calculate the net present value of a series of cash flows not just one individual cash flowThe formula works in the same way however each cash flow has to be discounted individually and then all of them are added together. The return that could be earned per unit of time on an investment with similar risk is the net cash flow ie.

Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return. Where is the time of the cash flow is the discount rate ie. Present Value vs Future Value Knowing the difference between present value and future value is very important for investors as present value and future value are two interdependent concepts that provide an utter help for the potential investors to make effective investment decisions.

NPV is a common technique used in capital budgeting and investment planning. Present Value 96154 92456 88900 85480. Present Value Therefore the present-day value of Johns lottery winning is.

This means the higher the discount rate the lower the present value of future cash flows. Net Present Value NPV is the value of all future cash flows positive and negative over the entire life of an investment discounted to the present. It is calculated as follows.

It is the rate at which the future cash flows are to be discounted and it is denoted by r. Each cash inflowoutflow is discounted back to its present value PV. Future cash flows are discounted at the discount.

Discounted Amount for FD 1374335. Net Present Value NPV represents the difference between the present value of cash flows and the present value of cash outflows for a project or investment. Cash inflow cash outflow at time t.

The Discounted Cash Flow DCF formula is an income-based valuation approach that helps determine the fair value or security by discounting future expected cash flows. In finance discounted cash flow DCF analysis is a method of valuing a security project company or asset using the concepts of the time value of moneyDiscounted cash flow analysis is widely used in investment finance real estate development corporate financial management and patent valuationIt was used in industry as early as the 1700s or 1800s widely discussed. This is the sum of the present value of cash flows positive and negative for each year associated with the investment discounted so that its expressed in todays dollars.

ABC Incorporation wants to invest in on-the-run treasury bonds Treasury Bonds A Treasury Bond or T-bond is a government debt security with a fixed rate of return and relatively low risk as issued by the US government. The constant perpetuity and the interest. Is the difference between the present value of cash inflows and.

When a company or investor takes on a project or investment it is important to calculate an estimate of how. Net Present ValueNPV is a formula used to determine the present value of an investment by the discounted sum of all cash flows received from the project. This rate of return is discounted from the future cash flows.

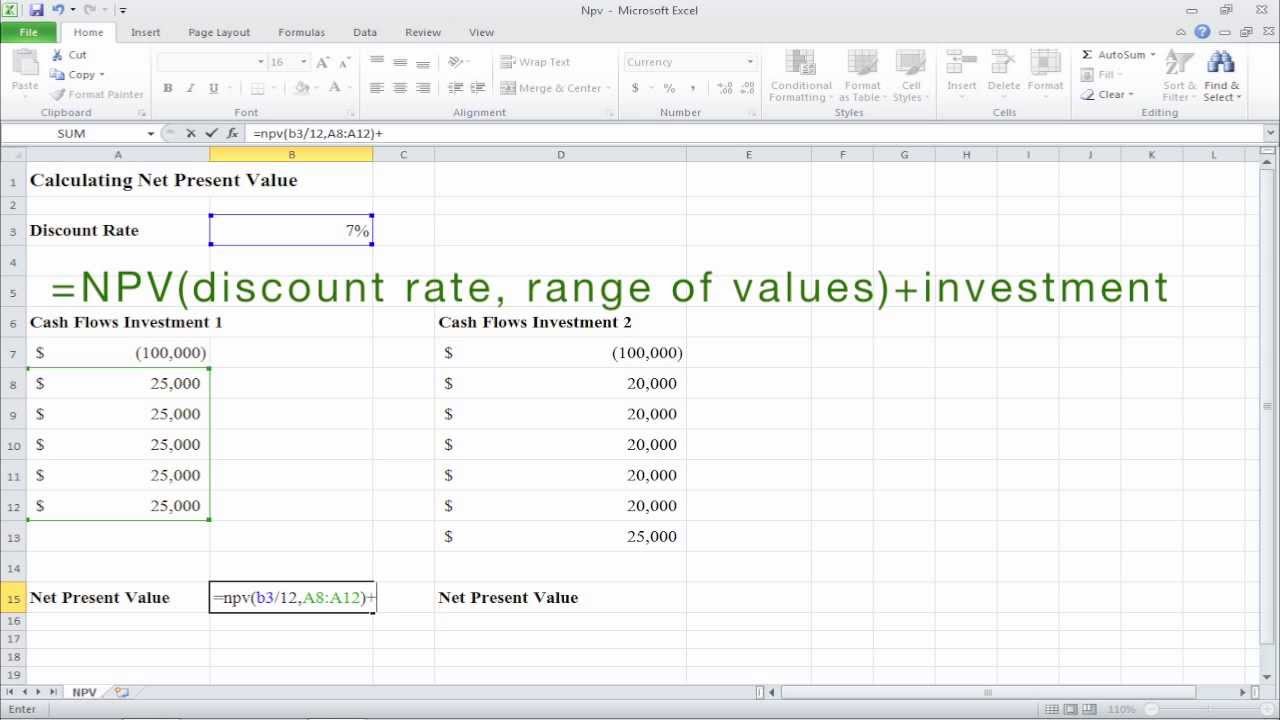

Calculate Npv In Excel Net Present Value Formula Excel Excel Hacks Formula

Npv Calculator Calculate And Learn About Discounted Cash Flows

How To Calculate Net Present Value Npv In Excel Youtube Accounting Basics Financial Analysis Calculator

How To Use Discounted Cash Flow Time Value Of Money Concepts Money Concepts Cash Flow Time Value Of Money

5 2 Present Value And Discounting Presents Economics Solutions

Present Value

Present Value Of Uneven Cash Flows All You Need To Know Cash Flow Financial Life Hacks Financial Management

How To Use Discounted Cash Flow Time Value Of Money Concepts Time Value Of Money Money Concepts Finances Money

Present Value Table Meaning Important How To Use It Managing Your Money How To Raise Money Skills To Learn

Net Present Value Npv Financial Literacy Lessons Cash Flow Statement Accounting Education

Lump Sum Present And Future Value Formula Double Entry Bookkeeping Time Value Of Money Accounting Education Accounting Principles

Present Value Vs Future Value 6 Best Differences With Infographics Project Finance Business Valuation Time Value Of Money

Pv Function Learning Microsoft Excel Excel Templates

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

Present Value

How Internal Rate Of Return Irr And Mirr Compare Returns To Costs Cost Accounting Business Case Rate

Discount Factor Formula How To Use Examples And More Discount Formula Accounting Basics Economics Lessons